34+ How much can u borrow for mortgage

You can calculate your mortgage qualification based on income purchase price or total monthly payment. Conventional 30 year fixed.

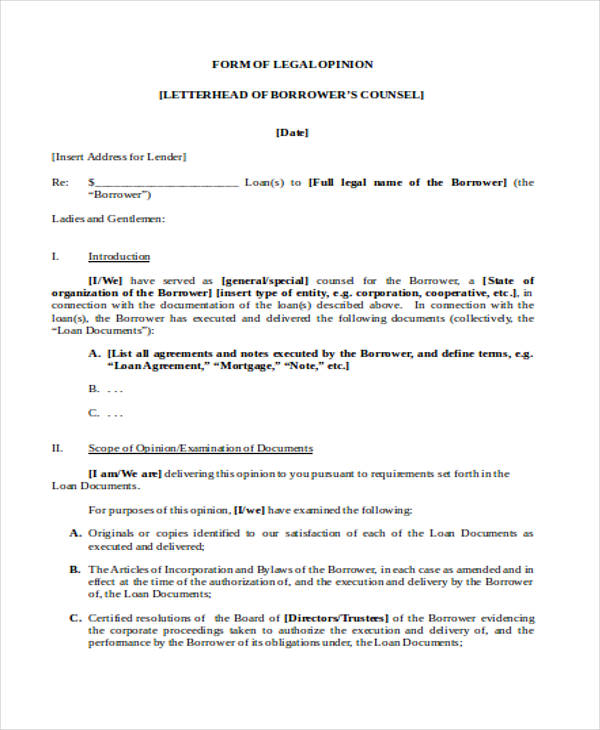

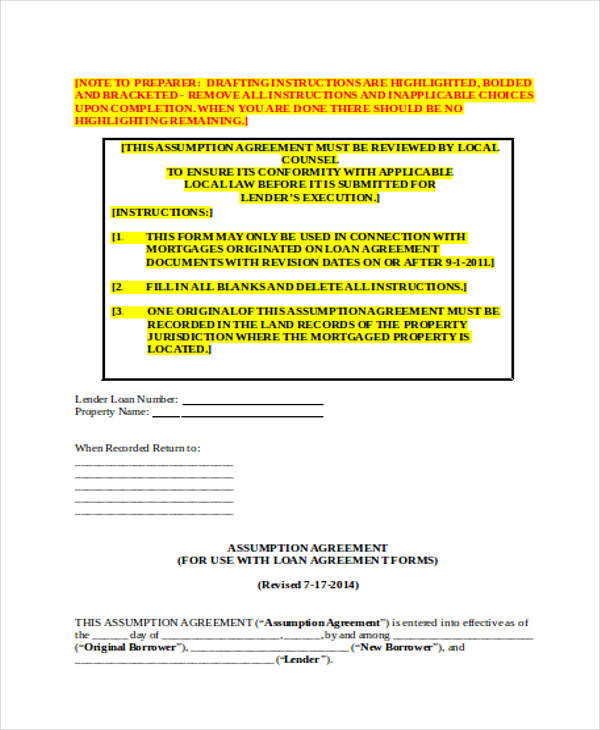

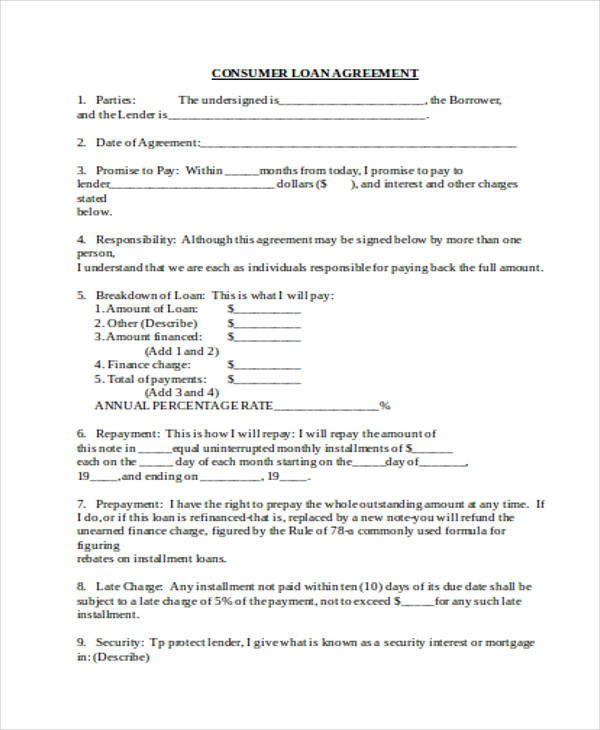

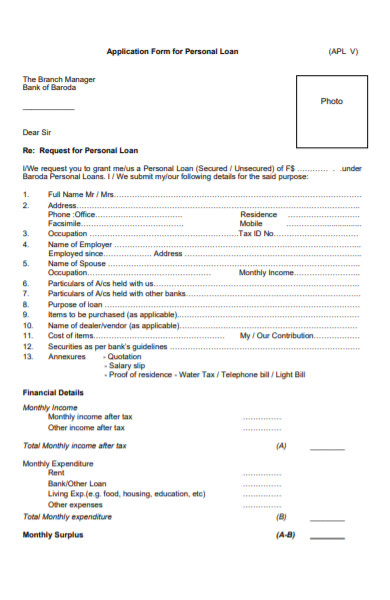

Free 34 Loan Agreement Forms In Pdf Ms Word

Under normal economic circumstances you might be able to borrow between 80 and 90 of your available equity.

. A bigger down payment or taking a little less cash out may snag you a better rate. With a 30-year fixed-rate mortgage you have a lower monthly payment but youll pay more in interest over time. It pays to find a home and mortgage deal you can afford.

Your loan-to-value LTV ratio is a measure of how much of your homes price you borrow. Mortgage rates pulled back this week but economic uncertainty continues to keep price-struck buyers at bay. As a general rule of thumb you can borrow 5 times your individual or combined spouses partners income for a repayment mortgage in France less the value of your existing mortgage balances ie outstanding debts on other properties.

This is the prescribed cap on loan amounts you can borrow for conforming loans. However to get. We assume homeowners insurance is a percentage of your overall home value.

Fixed-rate loans are ideal for buyers who plan to stay put for many years. Few lenders will let you borrow against the full amount of your home equity. Program Mortgage Rate APR Change.

Conventional 30 year fixed. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. Conventional 15 year fixed.

Department of Veterans Affairs VA loan carried an interest rate of 299 according to mortgage application processing software company Ellie Mae. To get the best mortgage loan know how much you can afford and shop like the bargain hunter. If a house is valued at 180000 a lender would expect a 9000 deposit.

Stock holdings might get an advance rate of 50 whereas US. A 30-year fixed loan might give you wiggle room to meet other financial needs. How much one can borrow depends on the quality and safety of the collateral.

How lenders decide how much you can afford to borrow. It can get expensive so its best to prepare more funds. Real estate 40 cities that could be poised for a housing crisis.

The average American family can no longer afford to purchase a median-priced home when mortgage rates go above 57 says Nadia Evangelou senior economist with the National Association of Realtors. With interest only mortgages you can borrow 10 times your income less outstanding mortgage balances. Conforming limits may be lower or higher depending on the location of the house.

In this example the lender would be willing to offer a loan amount of 171000. Each mortgage point can usually lower your rate by 125 to 25 basis points which equals 0125 to 025. Few homes are built to last 100 years.

They typically request at least 5 deposit based on the value of the property. The average 30-year Federal Housing Administration FHA loan by contrast was much more expensive with an average interest rate of 339. Treasury bills might have an advance rate of 95.

In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options. How Much Can You Afford to Borrow. We can calculate exactly what closing costs will be in your neighborhood by looking at typical fees and taxes associated with closing on a home.

We use current mortgage information when calculating your home affordability. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. In December 2021 the average 30-year US.

Consider an adjustable-rate mortgage ARM. Lenders generally prefer borrowers that offer a significant deposit. If this is the maximum conforming limit in your area and your loan is worth 600000 your mortgage can be sold into the secondary.

The most common loan terms are 30-year fixed-rate mortgages and 15-year fixed-rate mortgagesDepending on your financial situation one term may be better for you than the other. 5588 03 Conventional 15 year fixed.

Mortgage Note Sample Check More At Https Nationalgriefawarenessday Com 33628 Mortgage Note Sample

Free 34 Loan Agreement Forms In Pdf Ms Word

Are You Thinking Of Getting A Reverse Mortgage Who Should Consider One And Who Shouldn T U Reverse Mortgage Estate Lawyer Real Estate Investing

Do You Agree With Warren Here Warren Buffett Believes Investors Should Avoid Using Borrowed Money To Buy St How To Get Rich Warren Buffett Trading Quotes

Free 34 Loan Agreement Forms In Pdf Ms Word

You Poor Thing You Can T Pay Your Mortgage Or Bills Because You Bought An Iphone Coach Purse And A Vacation Geez And Here I Was Feeling Bad Because I Do Pay

Infographic Saving For The Unexpected Personal Savings Saving Finance

Your Mouth Is Telling Me You Can T Afford To Pay Back The Money I Loaned You But The New Shoes On Your Feet Are Telling Me Another Story Money Quotes Funny

14 Best Loan Company Wordpress Themes Templates 2019 Download Now Free Premium Templates

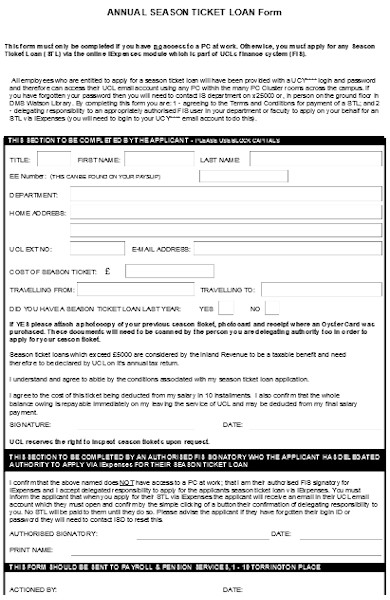

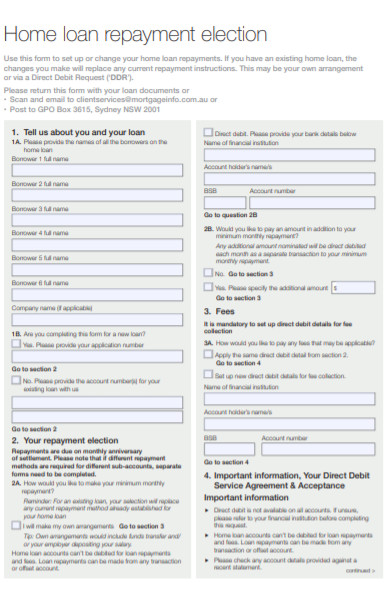

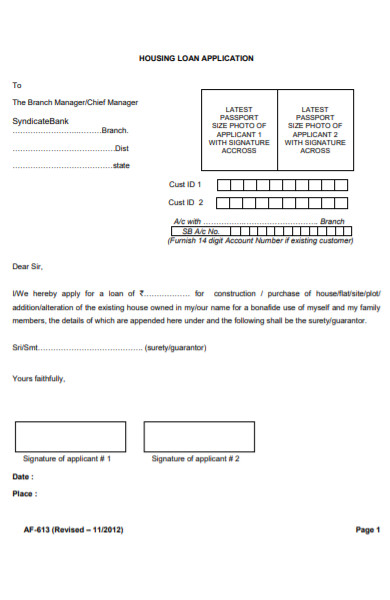

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel

Pin By Joanne Kuster On Money Budgeting Ideas Budget Creator Budgeting Scholarships

Free 34 Loan Agreement Forms In Pdf Ms Word

Best Boat Loans For 2022 Compare Rates Offers Today

14 Best Loan Company Wordpress Themes Templates 2019 Download Now Free Premium Templates

Free 55 Loan Forms In Pdf Ms Word Excel

Free 55 Loan Forms In Pdf Ms Word Excel