Series ee bonds calculator

For an EE bond bought from May 2022 through October 2022 the rate is 010. That rate is applied to the 6 months after the purchase is made.

Bond Calculator Hot Sale 54 Off Www Wtashows Com

Series EE Series I.

. More on Rates and Terms. If you later find the original bonds you must return them to our office. Gift savings bonds are technically just a version of Series EE and Series I savings bonds.

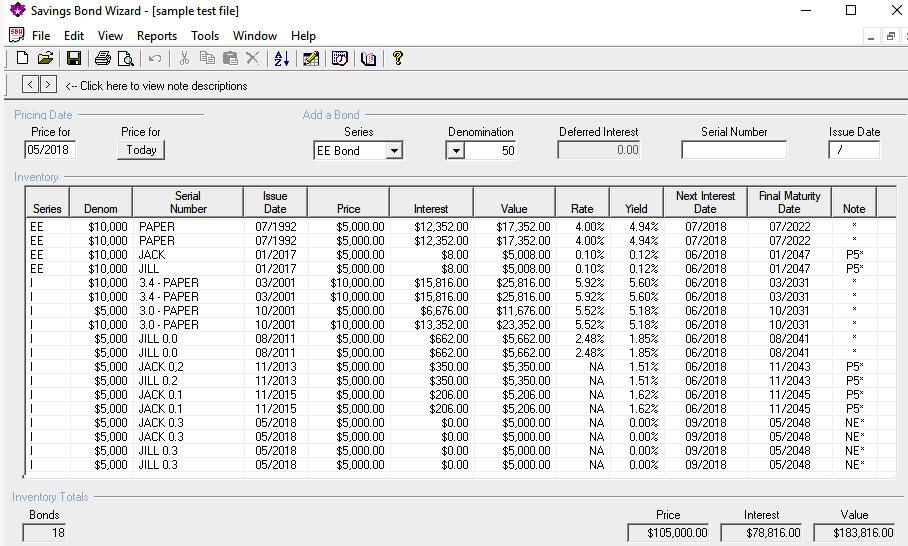

HH bonds came in these denominations. Series EE Bonds Issued May 2005 and Later Series EE bonds issued from May 2022 through October 2022 earn todays announced rate of 010. Find the value of your savings bonds Calculator.

Starting with a 25 bond you can buy up to 10000 per year online at TreasuryDirectgov. Unlike EE bonds however I bonds are issued at face value. EE bonds issued in May 2005 and after earn a fixed rate of return.

What is an EE bond. I Bonds can be purchased through October 2022 at the current rate. May 1997 April 2005.

Series EE bonds issued after 2005 accrue interest at a fixed monthly rate which is compounded semi-annually. HH bonds were sold at face value. Treasury announces the rate for new bonds each May 1 and November 1.

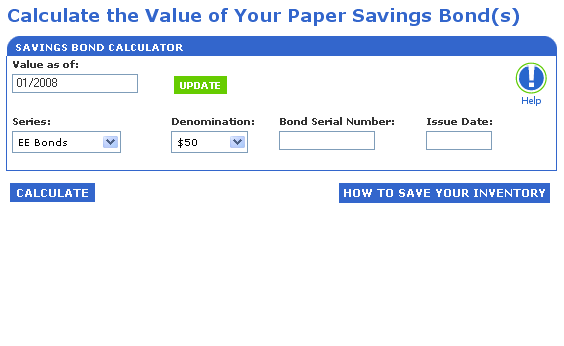

The Savings Bond Calculator tool which is helpful for calculating redemption values also can be found on. Cash paper savings bond. 500 1000 5000 10000.

See Tax Considerations for HH bonds. Gift purchases are attributed to the recipient. EE bonds issued from May 2005 on EE bonds we sell today earn the same rate of interest a fixed rate for up to 30 years.

The initial interest rate on new Series I savings bonds is 962 percent. EE bonds issued since May 2005 earn a fixed rate of interest. Series I Savings Bonds.

In the past you purchased paper bonds at half of their face value that is you paid 50 for a 100 bond whereas now electronic bonds are purchase at their face value. Comparing Series EE and Series I Savings Bonds. Interest gets added to the bond monthly and the government guarantees that the bond will double in value after 20 years.

We conduct a series of betting market auction and committee experiments using 15 classic cognitive bias tasks. That is a 500 bond cost 500. How to buy Series EE.

Series EE bonds are a type of low-risk US. This is the only way to get paper bonds anymore and youll need to file IRS Form 8888 to gain eligibility. You calculate the value of a series of equal payments each year over time.

Series EE savings bonds have a fixed interest rate Series EE bonds issued before May 2005 may have a variable rate. For an EE bond bought from May 2022 through October 2022 the rate is 010. The influence of behavioral biases on aggregate outcomes like prices and allocations depends in part on self-selection.

Treasury offers a savings bond calculator that can help you figure out. The Treasury also offers zero-percent certificate of indebtedness C. If your 10-year 1000 pays 10 interest each year for example you would earn a fixed amount of 100 per year for 10 years.

Treasury with a 30-year term they are an. After 30 years. Treasury currently offers two series of savings bonds.

The initial interest rate on new Series I savings bonds is 962 percent. You can redeem the bond after only one year of. All Series EE bonds issued since May 2005 earn a fixed rate in the first 20 years after issue.

When you buy the bond you know the rate of interest it will earn. EE bonds issued since May 2005 earn a fixed rate of interest. Please contact Savvas Learning Company for product support.

We document that. A REVIEW OF SERIES I BONDS The government issues series I bonds in the same denominations as series EE bonds50 75 100 200 500 1000 5000 and 10000. Even though series EE bonds dont reach full maturity until 30 years you dont have to wait this long to cash in the bond.

How Treasury auctions work. Comparing I Bonds to EE Bonds. The rates and terms for an EE bond depend largely on when the bond was issued.

The Savings Bond Calculator tool which is helpful for calculating redemption values also can be found on. Consider how a bond works and why bonds are issued. Once you receive replacement bonds or payment for lost bonds the original bonds become the property of the US.

When you buy the bond you know what rate it will earn for at least the first 20 years. Series HHH bonds are a little different you pay face value and receive interest payments by direct. You can buy I bonds at that rate through October 2022.

For example if you buy an I bond on July 1 2022 the. Electronic Series EE savings bonds purchased via TreasuryDirect are sold at face value. The annual purchase limit for Series I savings bonds in TreasuryDirect is 10000.

Because they are issued by the US. What bonds might I have. A Series I bond earns interest based on combining a fixed rate and an inflation rate.

Savings bond that are guaranteed to double in value after 20 years. For example you pay 25 for a 25 bond. You can buy EE bonds and I bonds in electronic format in TreasuryDirectYou can buy paper I bonds with.

A series EEE bond earns a fixed rate of interest for up to 30 years. EE bonds and I bonds are sold at face value and they both earn interest monthly that is compounded semiannually for 30 years. All H bonds have matured.

Each person may invest in up to 10000 of Series EE or Series I bonds. As a matter of fact. All Series EE bonds issued since May 2005 earn a fixed rate in the first 20 years after issue.

Before Series HH savings bonds we issued Series H savings bonds. Series EEE Series I or Series HHH. Interest rates for Series EE.

Paper EE bonds last sold in 2011 were sold at half of face value. However you will go through a slightly different process to. Six months - so all HH bonds have passed their.

Entities issue bonds to raise money for a specific purpose. HH bonds were issued only on paper. Whether rational people opt more strongly into aggregate interactions than biased individuals.

Is there a minimum time to keep HH bonds. Clients may buy a maximum of 60000 worth of I bonds each year. Both I bonds and EE bonds may be redeemed or cashed after 12 months.

30000 in paper bonds and 30000 in electronic bonds. Treasury Hunt Securities we sell. Series EE Bonds Issued May 2005 and Later Series EE bonds issued from May 2022 through October 2022 earn todays announced rate of 010.

When you buy the bond you know the rate of interest it will earn. You can buy I bonds at that rate through October 2022. There are a few types of bonds you may have.

1 2012 financial institutions stopped selling paper bonds. Now you may only obtain Series EE bonds by purchasing them electronically at TreasuryDirectgov. Should you go this route purchases must be in 50 increments.

A bond is a debt instrument. May 2005 and Later. EE bonds issued from May 1997 through April 2005.

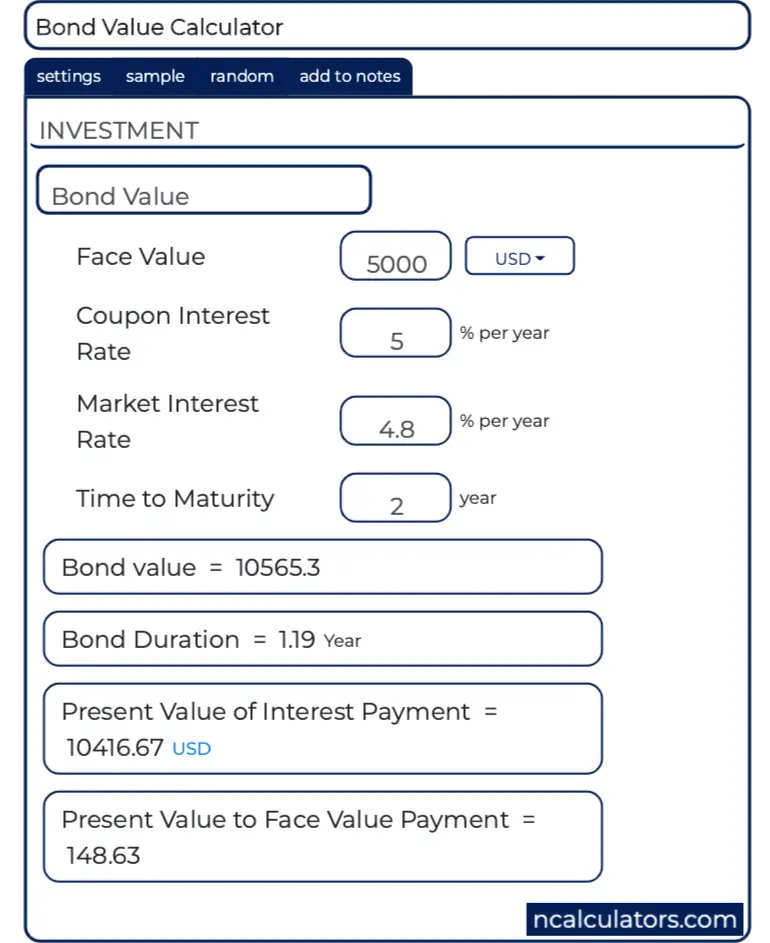

The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bonds term.

Download Modified Adjusted Gross Income Calculator Excel Template Exceldatapro Adjusted Gross Income Income Federal Income Tax

Download Schedule B Calculator Apple Numbers Template Exceldatapro Number Templates Templates Apple

How To Calculate Carrying Value Of A Bond With Pictures Cpa Exam Bond Raising Capital

Bond Calculator Hot Sale 54 Off Www Wtashows Com

Download Schedule B Calculator Excel Template Exceldatapro Excel Templates Federal Income Tax Calculator

Should You Redeem Your Savings Bond Use This Calculator To Find Its Value

The Beginner S Guide To Budgeting When You Re Broke A Fresh Start On A Budget Budgeting Budgeting Tips Money Advice

Bond Calculator Hot Sale 54 Off Www Wtashows Com

Bond Calculator Hot Sale 54 Off Www Wtashows Com

/what-to-know-about-savings-bonds-4179025-final_HL-c753932497bb4912ba70345b82462cd6.jpg)

How To Check Or Calculate The Value Of A Savings Bond Online

What To Do With A Savings Bond From Your Childhood Bankrate

Bond Calculator Hot Sale 54 Off Www Wtashows Com

Where Is The Serial Number On A Savings Bond Insurance Noon

Bond Calculator Hot Sale 54 Off Www Wtashows Com

How To Calculate The Annual Rate Of Return On A Bond Our Deer Bond Annual Finance Advice

Bond Calculator Sale 55 Off Www Wtashows Com

Here S A Step By Step Guide To Using The Treasury S New Savings Bond Calculator Seeking Alpha